Case of Bitrix24 integration for Prestalatino company

Prestalatino gives out micro loans in Mexico. This company successfully operates in Russia and enters the market of several developing countries. Below we will discuss the entry into the market of Latin America - the Prestalatino project.

The client invests in automation and business processes. To be faster and more efficient, they actively use online databases and services. Starting with the bailiffs' database and ending with the automatic transfer of the debtor’s case to court.

What was interesting

Four complex business processes only at the first stage.

-

Issuance of credit

-

Repayment of the loan

-

Work with debtors

-

Cold ringing.

Five integrations:

-

Integration with website

-

Integration with external databases - public services and private paid systems.

-

Integration with payment systems - almost no one uses bank cards, there are no aggregators as a class.

-

Integration with the service for sending SMS.

Business process of manual application verification

One of the most important processes for a credit organization is the assessment of the borrower. It is important to give money to someone who then pays back.

Despite the name (manual check of the application), in the business process they also use automatic checks on external bases (about them below). And on the part of the company, employees perform in three roles:

-

Credit managers - responsible for receiving primary information from the client;

-

Underwriters - responsible for checking the credit application and making a decision;

-

Managers - control each stage, make the final decision on the money transfer.

The business process is implemented on the standard business process constructor Bitrix24. We used business process on Stages. There were ten Stages of the Deal. Some steps of business process had to develop independently.

One of such interesting steps was the step of the “Call with information input” business process.

Business process “Call with information input”

There are several steps in the Prestalatino business process when you need to call a cell phone and enter information during the call. These are the primary call to the client, verification of the employer, verification of contact persons and the final call to the client.

At each of the steps, a special conversation script was prepared for the employee - which of the questions to ask, what could be the answer options. We developed the “Call with input of information in the Bitrix business process”, so that the employee confidently led the conversation and recorded the results. The call went through telephony B24.

This solution saved time - there was no need to go to other pages, no need to write information on a piece of paper and then enter it.

Integration

Integration with the web-site

Loan requests came from the landing page to the CRM-system. We used Rest API of Bitrix24 for integration.

An interesting challenge was the transfer of data from a three-step form. We agreed that the application will be created in the first step, and in the next steps we will enrich it with additional data. We carry out the parsing in parallel with the filling in the form on the website, so that the creation of the application does not "slow down".

Another interesting challenge was the signing of the contract.

While creating an application, the site generates a pin code. It is transmitted to Bitrix24. When the application is approved, Bitrix24 sends a message to the user with a link to the site and a request to enter the phone number and PIN code there. After that, we consider the contract signed and the site informs us (Bitrix) about it, moving the deal to the next stage.

There are already three systems involved at once - the website, Bitrix24, and the service for sending SMS.

.png)

Integration of Bitrix24 with SMS sending service

Difficulties:

-

Service API was described in Spanish.

-

The support service answered slowly and in bad English.

-

Problems with sending Spanish symbols.

-

If the SMS limit of 150 characters is exceeded, the message simply can not be sent.

We developed in Bitrix24 creating templates for SMS. Also we developed the step in Business Process, which allows you to send SMS.

Integration with payment systems

The situation was complicated by the fact that in Mexico, bank cards are not common. At least in the field of microcredit. We have to connect with local payment agents who transfer money to their internal accounts.

We worked with four payment systems:

-

Billmo;

-

OpenPay;

-

Extra;

-

Oxxo.

.png)

Integration with the Billmo payment system

The payment system itself is a mobile application.

We did everything we were asked for – studied their API, implemented the connector, and started sending payments from Bitrix. But with incoming payments (and this is the most interesting when you issue loans) everything was more complicated. We implemented a web service, described our API in English in a well-structured document and passed it to colleagues from Billmo.

Quite quickly (after 2 weeks!) received the answer that “It looks ok”, but then it did not move further. Until now, the paying agent returns incoming payments in .xlsx format once a day. We had to import such payments in the .csv format.

.png)

Open Pay Integration

After two months of correspondence with colleagues from Open Pay, we managed to connect outgoing payments. However with incoming payments again there was a difficulty. In order for the client to pay the loan, you need to implement a personal account for him on your website, integrate the account with the payment system and “sign” his transfers in a special way. The task is clear and solvable, but it has only been in the plans so far.

.png)

Integration with Oxxo and Extra

This is the most interesting integration in terms of the work logic.

When the loan is approved, the client is given a barcode (for example in a .PDF file). They save this barcode on the phone and go to the Oxxo chain of stores. They have the barcode scanned and identity confirmed. After that the client receives the money.

The client is returned in the same way – by scanning the barcode in the store.

We studied the specification of the formation of the barcode, clarified quite a lot of questions and figured out all the nuances.

After that, colleagues from Oxxo were supposed to create access codes for the service for us. But (quote):

"OXXO integration will only begin in January, now is the high season."

“CCK (Extra) will send us a document to develop the system, but with minimal control - in Spanish, which means that no one will answer any questions. Their entire IT staff was already engaged in resolving their own issues. ”

As a result, we can send payments from two payment systems. We can receive payments only in one payment system, and information about such payments is sent to us by mail in .xlsx files.

.png)

Interesting improvements Bitrix24

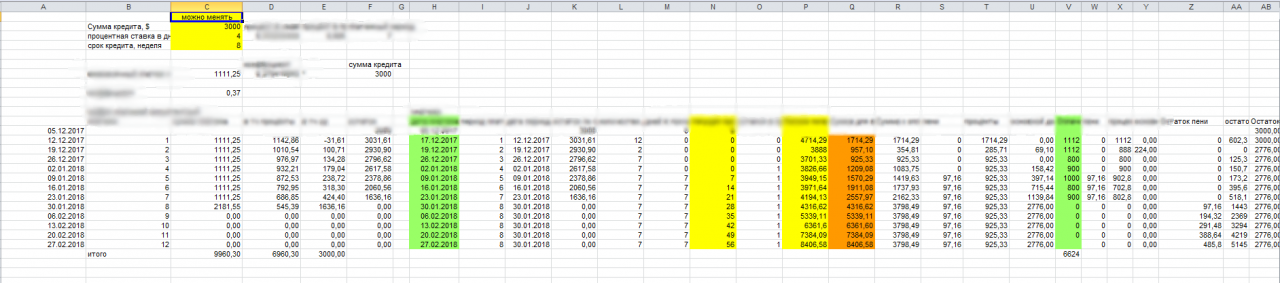

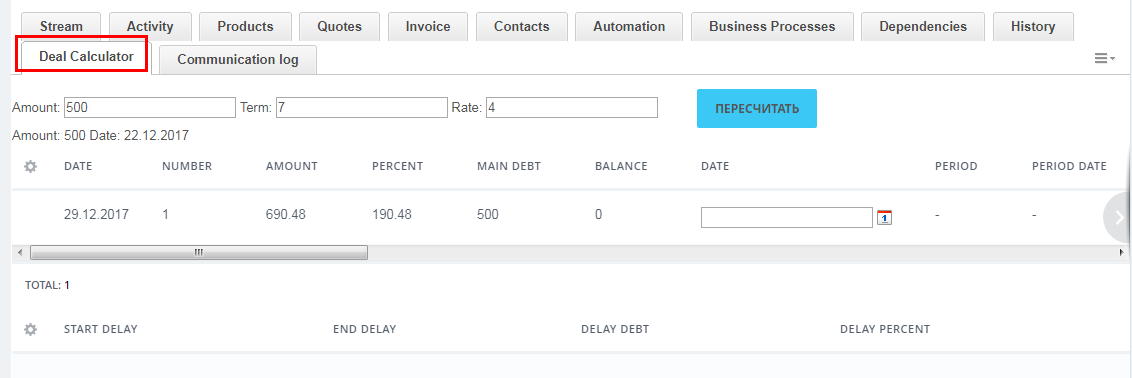

Loan calculator and calculation of payments in Bitrix24

The calculation of the schedule of payments, delinquencies and other sums for entering the schedule is a difficult thing for the uninitiated. Suffice it to say that even in a simplified calculator (they gave us the source in .xlsx) there are more than 25 columns with big formulas.

To make employees comfortable, these calculations need to be carried out automatically in Bitrix24. It is enough to open a Deal - based on the previously entered data, we will calculate all the necessary payments. If the client has already started to pay the loan, we will show the payment history and calculate the delay and penalties, as well as recommendations on the size of future payments.

It is important that the employee can change the input parameters (dates and amounts of payment) and immediately see the changes in the amount of interest, penalty and other data. This allows an employee to make a full calculation on the basis of new introductory information while he is talking to a client by phone.

In addition to a separate tab in the transaction, we implemented a loan calculator in a common CRM interface. There, the employee can calculate the payment schedule and the amount of interest for new customers.

Comprehensive support for the company's work in Bitrix24

In Prestalatino several hundred (sometimes thousands) transactions can be processed per day. The main work is done Bitrix24. With such volumes, comprehensive support is needed. We have the competencies and resources to provide this service. By comprehensive support, we mean:

-

Technical user support;

-

Development of instructions and training;

-

Server support;

-

Monitoring with notifications by mail, mobile or Telegram;

-

Backup organization;

-

Urgent improvements.

It is important that we have an SLA - an agreement on the quality of service. You will know exactly what we will do and in what time framework.

Using Bitrix24 to automate financial companies

We can make certain conclusions:

-

The Bitrix24 platform allows you to successfully automate the activities of financial companies.

-

B24 without modifications, will not solve your problems. The standard version is not suitable for many different companies.

-

The Bitrix24 interface is quickly learned even by any user.

-

Business processes Bitrix24 is a powerful tool if you agree to put up with its interface. You can even automate really complex processes (from 5 roles, in several dozen steps, with returns between stages).

How much does it cost to use Bitrix24 to automate a financial company?

You have to understand, automation is not cheap. But if you use the B24, the budget for this task is acceptable. The cost of a described task is from 10,000$ per month.

The complex integrations with payment systems are the most time- and labor-consuming.

With a similar scale of the task, doing it in one go is a bad idea. Get ready for 3 - 6 months of step-by-step work.

- 20.11.2018

-

Anton Kolodnitskiy